Hey y’all!

Picture this: you’ve found the perfect engineer to join your startup as your first employee, AND they’re interested.

Then they ask “how much equity are you able to offer?”

You freeze — you’re wondering what they’re expecting, what’s normal, and how to negotiate.

The recommendations I read when I was starting out as a founder were highly inconsistent, but this playbook should help make all employee equity decisions easier 👇

How Much Equity to Give Early Employees

First… How to Set Up An Employee Equity Pool

An employee equity pool is the amount of shares set aside by the founders for distribution to employees. You’ll set one up when you’re first creating your company. Without it, you won’t be able to easily and quickly issue shares to new employees.

If you set up your corporate entity with Stripe Atlas, which I recommend, you’ll be able to select between 5-30% of your shares to remain “unissued” and be reserved for future distribution to employees.

Stripe defaults to 15%, and Carta claims the average is 13-20%, but I recommend lowering it to 10%.

You’re able to “replenish” the equity pool at any time by creating new, unissued shares. Typically, replenishments happen in tandem with fundraises since new shares are being created for the investors joining the round.

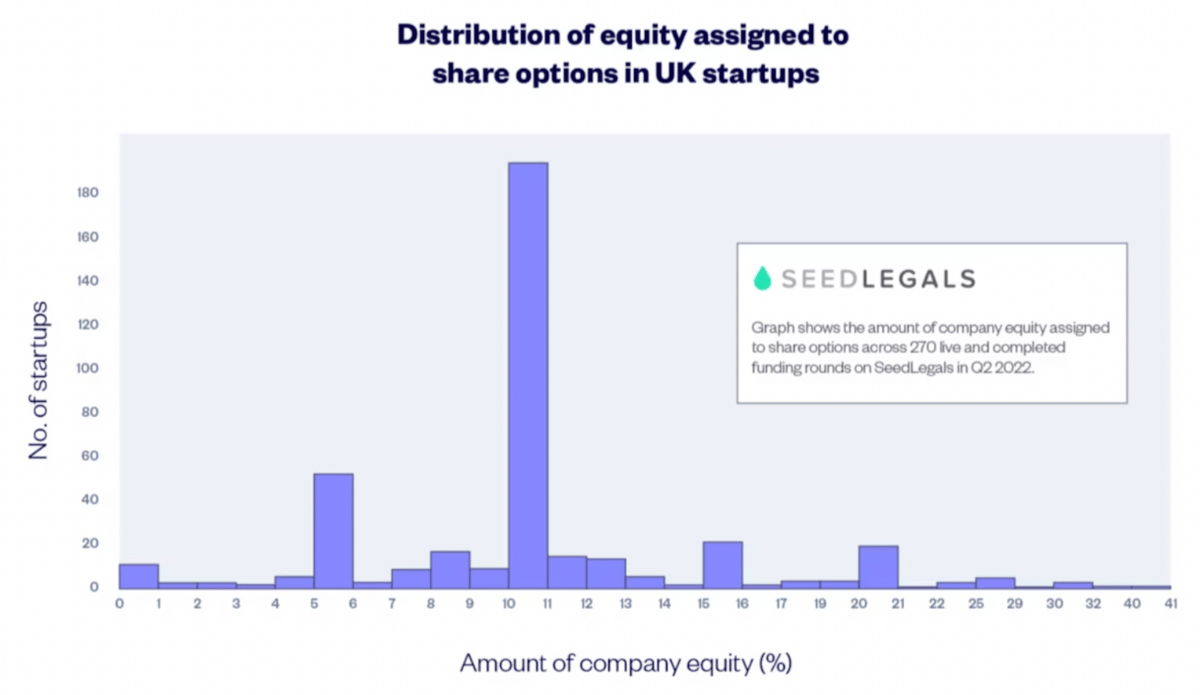

If you already have cofounders then 10% is plenty to get you to an initial fundraise, and the data below from UK startups shows it’s nearly standard (which has been my experience across the hundreds of founders I’ve worked with as well):

With that said, if you anticipate needing a high number of highly skilled employees (like specialized engineers) don’t be afraid to reserve a larger amount of equity for employees.

If you’re not using Stripe Atlas or a similar tool, you’ll likely want your corporate counsel’s taking care of the creation of the equity pool.