Hey y’all — I’m hosting a dinner for venture-backed founders in NYC on Thursday.

There are a couple spots left.

Want to come?

Reply for an invite.

Anyway, here’s today at a glance:

Opportunity → Earnings Call Transcript API

Framework → North Star Metric

Tool → Zapier

Trend → AI No Code

Quote → Avoid Venture Debt

🔗 Houck’s Picks

My favorite finds of the week.

Fundraising

Product

Growth

ICYMI

💡 Opportunity: Earnings Call Transcript API

What’s the most valuable currency in tech right now?

Aside from AI hardware, it’s data.

As more people realize this there will be increasing value in using uncommon or, ideally, proprietary datasets.

Here’s an interesting one you can build a lot on top of:

Earnings call transcripts.

Public companies share a lot of data on their earnings calls that’s obviously valuable for assessing financial markets, but likely also many other things.

The easiest way to take advantage of this right away?

Build an API that ingests, and makes available, all public company earnings calls.

🧠 Framework: North Star Metric

You’ve probably heard of north star metrics.

It’s the single metric you orient your company around, above all else.

Having one promotes alignment, focus, and a shared goal across the company.

But it’s important to make sure your north star meets a few criteria:

It isn’t more than one metric — you’d be surprised how often companies will say that different parts of their business have different north stars. This defeats the purpose.

It’s not an OKR. A north star doesn’t have a “key result” attached to it.

It’s directly related to customer adoption. The way you measure this can be based on attention, transactions, or productivity but in all cases the focus is on building your customers’ love for the product.

Here are some north stars and what a bad version would have been, instead:

🛠 Tool: Zapier

As one of my favorite tools, Zapier has saved me time and headaches through the years.

On Sep. 26th, Zapier is hosting ZapConnect so attendees can master AI and automation, with hands-on sessions and expert insights from industry leaders.

Register now for free (2 days left) to take your workflows — and your career — to the next level.*

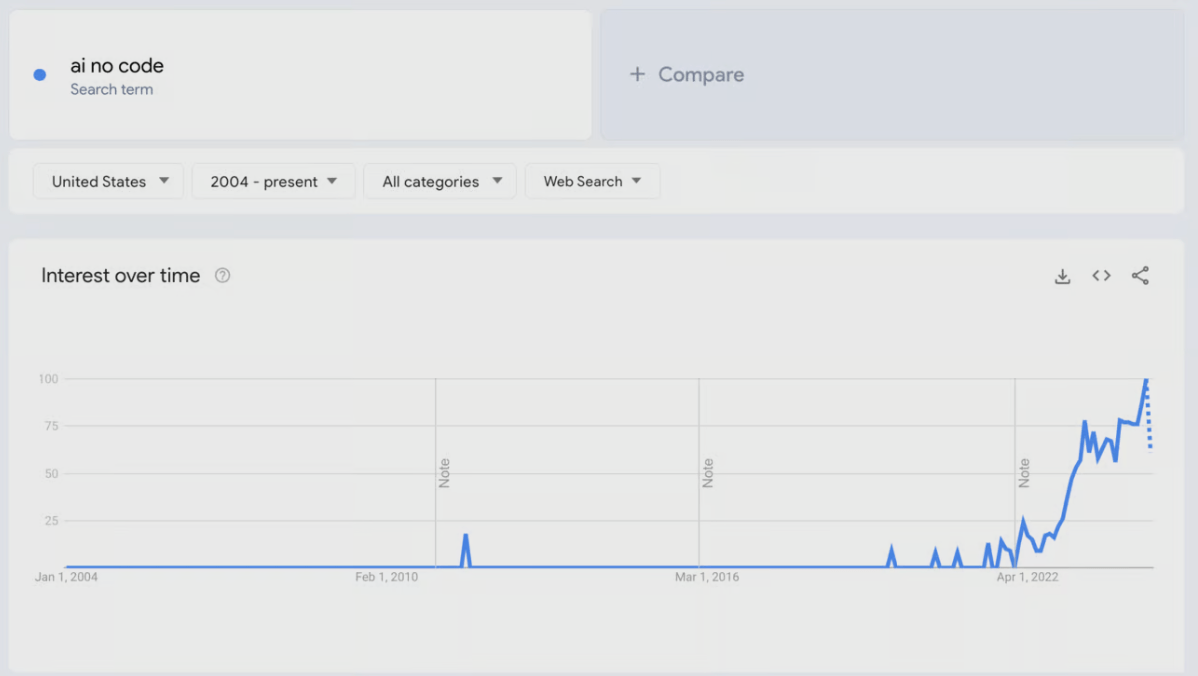

📈 Trend: AI No Code

On that note, I’m not sure if calling this trend “AI no code” is really fair.

“No code” tools are stuck in the middle — they require the user to either accept fewer customization options or not fully abstract away the complexity of building software.

This new type of tooling aims to give the user the full customization of having an engineer build something for them, while letting them direct it via a simple chat interface.

Regardless of what you call it, search interest has steadily grown since GPT-3 came out and is spiking again now.

What’s most interesting about this class of tool is that it can dramatically increase the amount of:

Shots on goal good founders can take

People who can start software companies

Amount of viable software business ideas there are (due to lower costs)

When coupled with the reduced demand for software engineer jobs across the board and more non-tech jobs being replaced by automation, I expect we’ll see a Cambrian explosion of these SMB-style software companies over the next decade.

💬 Quote: Avoid Venture Debt

Here’s a secret.

By the time you close your first priced round, and maybe even earlier, you’ll likely be approached by banks about:

Keeping your money in their bank relative to another

Taking on some “venture debt”

They make venture debt sound appealing. Your company is growing, why not take some extra money for minimal-to-no dilution?

The problem is that, unlike pure-equity investors, the banks don’t care if your company survives at all. They want their money back and they’re going to get it.

Even if it’s $0.10 on the dollar and it kills the company.

Of course, they’ll never say this is what will happen. And if things go well for your startup it’ll likely never come up.

But be careful. It’s not free money.

💡 How I Can Help

Become a member to join the community, get access to all 90+ deep dives, and fireside chats with experts.

Growth

Grow your audience + generate leads with my growth service.

Fundraising

Share your round with hundreds of investors in my personal network.

Hiring

Hire curated candidates from top startups and communities.

Advising

I’ll help solve a specific challenge you’re facing with your startup.

🚀 Advertise in this newsletter to get in front of 60,000+ founders.

“*” indicates sponsored content.