Hey y’all — not many founders will ever know what it’s like to build a startup that eventually IPOs… let alone two.

But Mike Cagney does.

He co-founded Figure.com with his wife, June, in 2017 and their blockchain-backed home equity lines of credit and other financial products led them to a booming IPO this September. Shares are up over 40% since.

Before Figure, he co-founded SoFi, which raised what at the time was the largest funding round in history — $1 billion from SoftBank’s Vision Fund in 2015 — and later IPO’d as well.

I caught up with him this week and he shared 5 key lessons that have guided his journey as a founder and led to massive success:

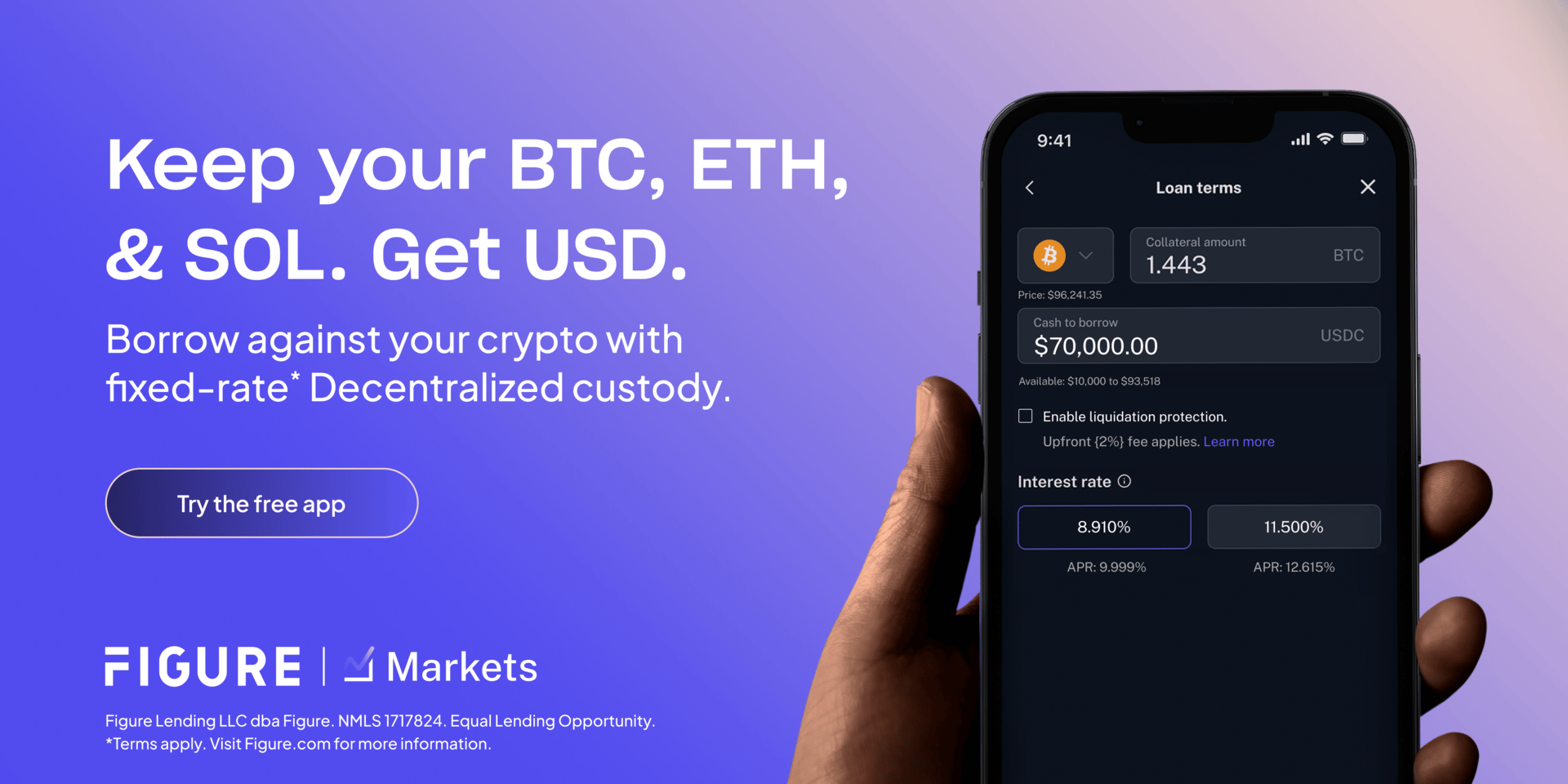

Need liquidity without selling your crypto?

Take out a Figure Crypto-Backed Loan, allowing you to borrow against your BTC, ETH, or SOL with 12-month terms and no prepayment penalties.

They have the lowest rates in the industry at 8.91%, allowing you to access instant cash or buy more Bitcoin without triggering a tax event.

Unlock your crypto’s potential today at Figure.

5 Lessons From Mike Cagney’s Two IPOs

#1: Don’t Fast Follow

Paul Graham says that the primary differentiator of a startup vs any other type of company is that it is designed to grow fast. So, following that logic means that founders who are building startups want to change the world.

But how do you actually change the world? It’s interesting to think about this, but many founders don’t apply this type of thinking to one of the most important decisions they make:

Choosing the market they’re going after.

Mike called out that there are two types of mistakes founders make here:

Going after a crowded market or one someone else fully owns, without any disruptive advantage

Copy/pasting a playbook that worked in one market into another and hoping for the best

In the first case, it echoes Peter Thiel’s classic take on why startups should focus on a small market rather than a large one:

In the latter case, ten years ago everyone was building “Uber for X” — they were taking a model that one startup had proved out, and trying to apply it to every other market under the sun.

Even today, I bet you can find startups founded in the AI era that are following this playbook.

“Uber for X” did yield some big companies, but mostly misses. I’d bet the hit rate of companies that reached IPO was lower than the average for startups that successfully raise at least some venture.

The lesson was to not bet your career on an iteration of someone else’s idea.

With Figure and SoFi, Mike focused on creating new markets by connecting sources and uses of capital directly, first through student loans and now via blockchain.

And his advice was to ask what problem you can solve that no one else is tackling. Find the whitespace. Find a market when it is early, but has the potential for rapid growth. And then move as fast as you can.

This is hard to do, but it’s how unicorns are built.

#2: Embrace the Unpredictable Path

Have you ever watched The Price Is Right?

It’s a classic American game show that has a bunch of “mini-games” that contestants play in order to win prizes.

One of those is called Plinko — and Mike compared a founder’s journey to the path of a Plinko ball on the board.

You go to the top of the board and drop a very bouncy ball into a minefield of bars that block its path. When it reaches the bottom, you get the amount of money that’s marked on the area of the board it falls into.

No matter how well you try to line up where you drop the Plinko ball with the slot at the bottom of the board, it’s going to bounce around and likely end up somewhere totally different. It’s impossible to predict.

Mike’s point was that you can’t predict where you’ll end up, but what you can control is your own North Star.

You have control over your mission, your vision, and your intrinsic driving force.

Stay committed to those, but flexible in execution, and realize that hard pivots can happen within the context of a bigger mission.

For Mike, his mission (even from companies he built and sold prior to SoFi) has been to connect the sources and uses of capital in society more efficiently. Primarily, he’s done this by removing middlemen and creating more control and opportunity for people on both ends of transactions.

Articulate what that is for you and stick to it.

#3: Don’t Fear Rules

Most founders I know avoid heavily regulated industries.

And I get it. They seem scary, and like a recipe for a slow-moving company or situations where incumbents can more easily crush you.

Bill Gurley’s incredible talk 2,851 Miles from the All-In Summit a couple years ago goes into some horror stories about regulated industries:

But they can also be exactly where a startup’s main advantage — speed — comes into play the most, if you can navigate around the land-mines.

This isn’t to say you should skirt the rules, but rather that you’re likely underestimating how slowly existing players are moving.

On one hand, regulation is the friend of the incumbent but, on the other, the resulting inefficiencies in regulated markets lead to complacence by incumbents. That’s opportunity.

Mike flagged that while you won’t be moving as fast as you would in a less regulated space, but you’ll be moving at a faster relative pace compared to your competitors.

Both Figure and SoFi operate in heavily regulated financial services spaces. Figure, in particular, has also successfully navigated the challenging and unclear regulatory environment for blockchain.

But because the opportunity is so large, Mike built a business that demonstrated blockchain’s value to both the regulators and the markets.

Mike’s POV here reminded me of how Palmer Luckey has approached the defense sector with Anduril, which is now worth $30 billion.

Defense tech wasn’t sexy in Silicon Valley for years. The New York Times even wrote about how Google employees were protesting a project that could have been potentially used for military drones in 2018.

And yet, 7 years later we have the Gundo and a16z writing about “investing capital to defend the nation” and raising billions to invest on the back of their American Dynamism thesis.

There are tons of regulated markets out there. And opportunities in them exist since most founders avoid them.

#4: Cut Out Middlemen

Mike’s vision for blockchain at Figure wasn’t about tweaking an existing system, but rather about eliminating entire layers of financial infrastructure.

Middlemen love to insert themselves into markets. For years, if you’ve been able to position your startup as a “tax” on an industry you’d be more likely to be able to attract funding.

Stripe is the best and most successful example of this — they are a tax on payments on the internet.

LLM credits are a tax on building AI tools.

The model works, but if we just endlessly add more middlemen, eventually everything will become too expensive.

It’s death by a thousand fees.

However removing these middlemen without sacrificing functionality, performance, or any other relevant metric in a given market will not only be lucrative but also build intense customer love and loyalty.

The trouble is that these types of opportunities are more rare to find and challenging to build.

But your chances of defining a category are much higher when you’re not putting lipstick on the pig, and instead aiming for structural disruption.

The best way to do this is to build a system that removes the need for middlemen entirely. Design your product and offer to remove, not enhance or piggyback off of them.

#5: Use Capital To Win

Masayoshi Son offered Mike $1 billion at SoFi instead of the $200 million Mike wanted, but he took it anyway.

You might think that sounds like an easy decision, but Mike told me it actually wasn’t an obvious choice (more detail on this in our full interview), but once he made the decision it allowed him tremendous flexibility.

All of a sudden he had capital to make principled, bold bets and experiment in ways competitors could not afford to. He was using capital to run faster than anyone else, and SoFi won the market as a result.

The lesson here is to not be afraid of taking on funding even if you don’t necessarily have it all figured out upfront.

The sheer leverage you gain from it will allow you to open up new opportunities for your startup, as Mike is proving once again with Figure.

How We Can Help

Become a member to get full access to our case study library, private founder community, and more.

We can also help your startup in a few other ways:

Content Creation

Let my team and I ghostwrite for your newsletter, X, or LinkedIn.

Growth

Grow your audience + generate leads with my growth service.

Fundraising

Share your round with hundreds of investors in my personal network.

Advising

I’ll help solve a specific challenge you’re facing with your startup.

Advertise in my newsletter to get in front of 60,000+ founders.

What'd you think of this issue?

Figure Lending LLC dba Figure 650 S. Tryon Street, 8th Floor, Charlotte, NC 28202. 888) 819-6388. NMLS ID 1717824. For licensing information go to www.nmlsconsumeraccess.org. Equal Opportunity Lender

Digital currency is not legal tender, is not backed by the government, and BIA accounts are not subject to FDIC or SIPC protections.

Crypto loans are offered to U.S. borrowers by Figure Lending LLC. This product is not available to U.S. residents of DC, ID, IL, KY, MD, MS, SD, TX, VT, or VA.

Crypto loans are offered through Figure Markets Credit LLC to residents of the state of New York and to international customers except in the following jurisdictions: Crimea (Ukraine), Donetsk (Ukraine), Luhansk (Ukraine), Afghanistan, Albania, Belarus, Central African Republic ,Congo (the Democratic Republic), Cuba, Ethiopia, Haiti, Iran (Islamic Republic of), Iraq, Lebanon, Libya, Mali, Myanmar (Burma), Nicaragua, Nigeria, North Korea (Democratic People's Republic of), Pakistan, Palestine (State of), Russia, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela, Yemen, or Zimbabwe.

The interest rate on Figure's Crypto-Backed Loan is 8.91% (9.999% APR) at 50% LTV or 11.50% (12.62% APR) up to 75%. The advertised Annual Percentage Rate (APR) is based on a $5,000 loan amount and contemplates the payment of 1% origination fee, which would yield a monthly payment of $42.47. Rates will be higher for applications secured by assets with a higher LTV ratio. The Figure Crypto-Backed Loan has a 12 month interest-only repayment term and allows for a maximum initial LTV ratio of 75%. Interest rates change frequently so your exact interest rate will depend on the date you apply and may depend on many factors such as LTV ratio.